No VA loan limits in 2020? You heard that right. The VA loan limits for 100% financing have been eliminated effective January 1, 2020. For high priced neighborhoods in Orange County this will have a dramatic affect for Veterans trying to buy a home. Veterans buying homes in Riverside and San Bernardino counties will also benefit greatly.

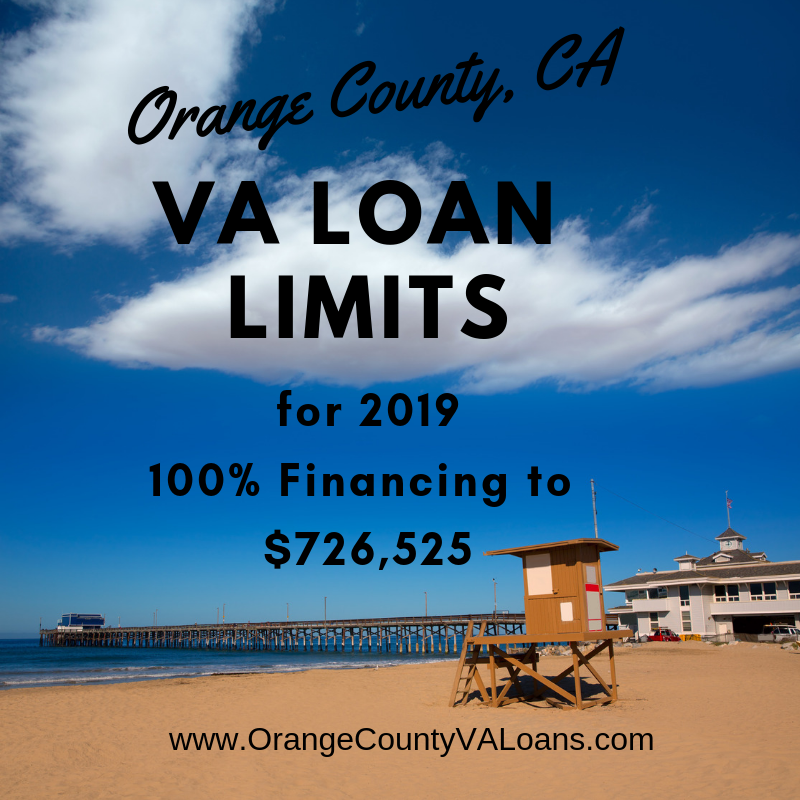

How VA Loan Limits Worked in 2019

Previously, the Veterans Administration would announce the upcoming 100% financing loan limit for each county in late November of the preceding year. Most recently the 2019 100% financing loan limit for Orange County was $726,525. This meant an Orange County Veteran could buy a home for a price as high as $726,525 with no down payment. (just don't forget about closing costs which do have to be paid). If the price was above $726,525 then the Veteran was required to come in with a down payment equal to 25% of the difference between the 100% loan limit and the purchase price. For example, if the purchase price was $1,000,000 then the down payment would be $68,368 (25% of the difference between $1,000,000 and $726,525). The VA loan would be $931,631 (before financing the VA Funding Fee, if applicable). Now, in 2020, no down payment is required.

Buy a $1,000,000 Orange County Home with $0 Down Payment

An Orange County Veteran purchasing a $1,000,000 property in Orange County now would not need any down payment.For that matter, the Veteran could buy a $2,000,000 with no down payment as long as they had enough income to qualify for the payment.

What You Need to Know Before Buy

There are things every Veteran should know before they buy a home. Really, they should know these things before they even think about making an offer on a home. Many times there is a big disconnect between the payment the Veteran is comfortable and the price of range homes they wish to purchase. Understanding the numbers involved in a purchase is critical in order to avoid frustration and potential financial disaster. Here are just a few of things to be aware of before looking at homes and getting your hopes up.

- Know you own budget. What is your net income after taxes? How much do you spend on meals and entertainment? How much is spent on car payments, student loans, other installment loans? Are you carrying credit card debt? Hopefully you have positive cash flow, or at least know exactly what it will take to have positive cash flow.

- Know what makes up a mortgage payment. It's not just Principal and Interest. The full mortgage payment also includes property taxes (can be anywhere from 1% to 2% of the purchase price divided by 12), home owners insurance (estimate using .25% of the loan amount divided by 12 - but you will shop for your homeowners insurance), and possibly Homeowners Association Dues if you purchase a condo or home in a PUD (Planned Unit Development).

- Know what payment your are comfortable with and that will fit in your budget. If you are pushing your budget, are you expecting a raise in the near future that will lessen the burden?

- Know that there are closing costs involved in a home purchase, even when using VA financing. Just like any home purchase, there will be escrow/settlement fees, title insurance, a VA appraisal fee, recording fees to the county, lender fees, inspection fees, notary, etc. Also, there will be "prepaid" expenses which include prepayment of property taxes, insurance. and mortgage interest. These are buyer costs. The seller will also have their own costs. Having a solid estimate of all the costs and fees involved is important in order to make sure you are not short to close when your closing date arrives. If you do not have money for closing costs or wish to keep you money in the bank, then you can negotiate upfront to have the seller pay some or all of your costs. This may put you at a disadvantage against other potential home buyers not needing the seller to pay closing costs but can put you in a good position with reserves in the bank after closing.

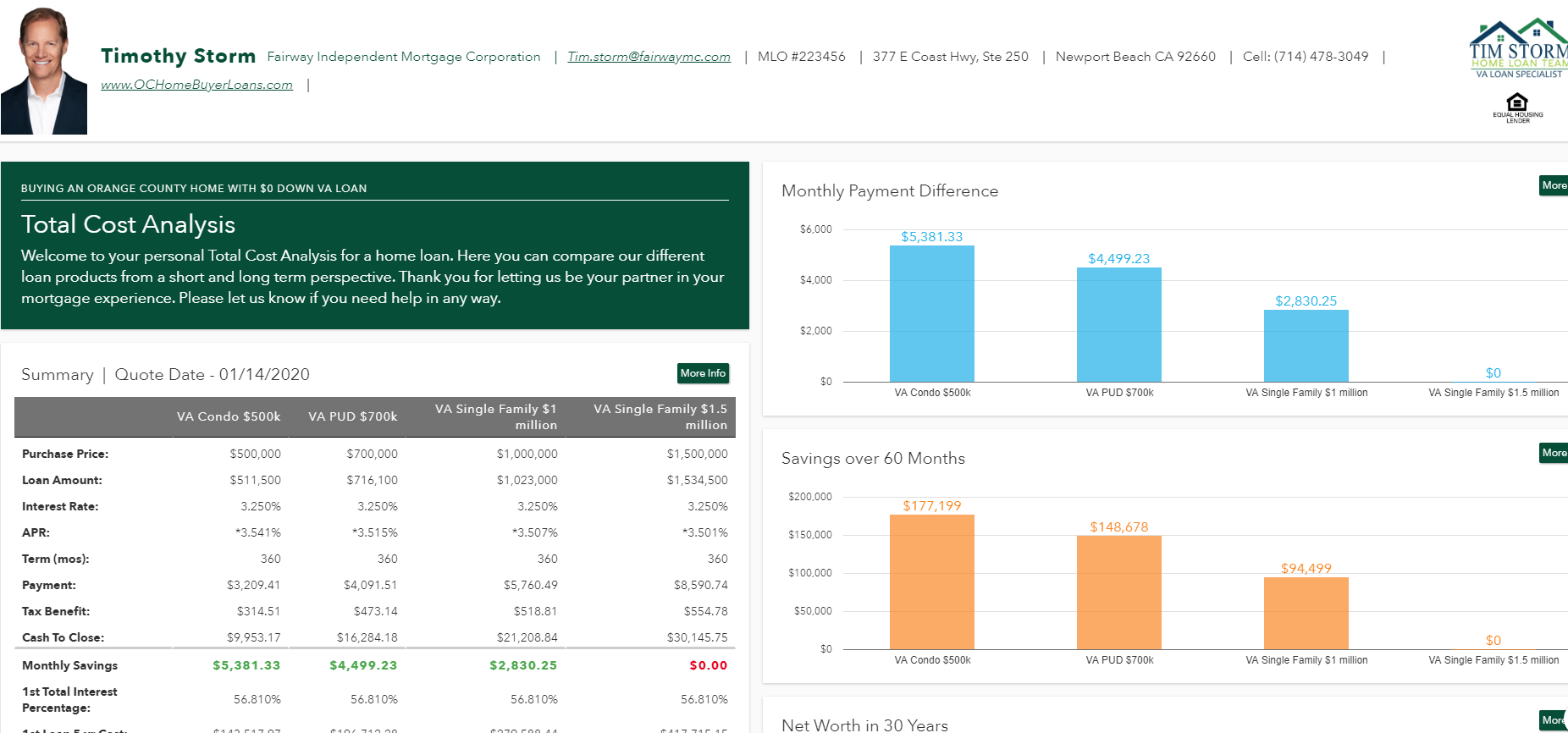

How to Get a Solid Estimate of the Numbers Involved in a Home Purchase

The best way to get an estimate of all the numbers involved in a VA home purchase is to work with an experienced VA Lending Expert. Ask for a VA Total Cost Analysis, which is prepared as part of the initial Pre-qualification process.The VA Total Cost Analysis will show you several "VA purchase scenarios" based on your preferred price range and payment comfort level. It will give you complete breakdown of payment for each home price as well as a breakdown of the costs involved in buying a home at each price.The TCA is delivered on a personalized web page and can be easily adjusted based on a specific property.

VA Loan PreApproval

The definition of a PreApproval varies from one lender to the next. Some lenders may just have the Loan Officer review you income documentation, run credit, and get an Automated Approval. Some lenders may not even do that much. There are some big online lenders who issue a PreApproval letter based on the initial borrower completed loan application without any review of the documentation. But in either of these situations, the final decision maker, the VA Underwriter, may have a different opinion of the loan package than the initial review by the loan officer. For this reason, you should ask for a "Fully Underwritten PreApproval".With a Fully Underwritten PreApproval your loan package is reviewed and Approved (or not) by an actual VA Underwriter. This is like walking into a car dealership with a check from your bank. Your financing is in place, provided the property meets VA requirements. This not only takes a lot of the stress out of the home buying process but also make your offer stand out among other competing "Prequalified" offers.

Authored by Tim Storm, an Orange County, CA Loan Officer specializing in VA Loans. MLO 223456. – Please contact my office at Fairway Independent Mortgage Corporation. My direct line is 714-478-3049. I will prepare custom VA loan scenarios that will be matched up to your financial goals, both long and short-term. I also prepare a Video Explanation of your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.