VA mortgage loans allow eligible Orange County Veterans to refinance their home to take advantage of lower interest rates that can ultimately save you sizable sums of money in both the long-run and the short-run by lowering your monthly payment. What many don’t realize is that the current loan does not need to be a VA loan.

VA mortgage loans allow eligible Orange County Veterans to refinance their home to take advantage of lower interest rates that can ultimately save you sizable sums of money in both the long-run and the short-run by lowering your monthly payment. What many don’t realize is that the current loan does not need to be a VA loan.

Many Orange County home owners are finding that if they currently have a Conventional loan, they can refinance into a VA loan if you are an eligible veteran or member of the armed services. Transferring from a Conventional mortgage to a VA mortgage is known as a “Conventional to VA Refinance Loan” and is a very straightforward process. Technically, VA considers a refinance from a non-VA loan into a VA loan to be “cash out”, even if the borrower is not getting cash back. And while many lenders will only allow a Conventional to VA refinance up to 90% of the properties value, there are lenders who closely follow VA guidelines and allow for 100% loan to value financing. In Orange County, where the VA 100% financing limit in 2013 is $668,750, this opens a lot of possibilities. And don’t forget, many lenders will finance up to a $1,500,000 VA loan. Some equity is required when the loan is greater than the 100% limit, but not as much as would be required for a “Jumbo” Conventional loan.

The “Conventional to VA Refinance Loan” process is described in detail in our article Can I Qualify For A VA Refinance If I Currently Have A Conventional Loan?

A common question related to VA refinancing is whether or not you combine a Conventional 1st mortgage with an equity line or fixed rate second mortgage. The answer is…you can! Even if the 2nd is greater than 100% of the properties value it is still possible to combine a portion of the equity line with the first mortgage and “subordinate” the remaining 2nd mortgage. There are loan to value restrictions in this scenario, typically capping out at 115% of the properties value.

VA IRRRL for Orange County Homeowners

Of course, you are also allowed to refinance your home if you currently have a VA mortgage. An Interest Rate Reduction Refinance Loan (IRRRL) is also known as a VA Streamline Refinance. This is a fast and easy way to lower your monthly mortgage payment and interest rate! And typically with the lender using a “lender credit” to cover some or all of the closing costs.

Some of the benefits of a VA Streamline Refinance or IRRRL include:

- In most cases you will not need to have an appraisal prepared. This saves time and cost.

- No income verification. Remember when you purchased your home and had to provide two years income documentation, paystubs, first born and a pint of blood.( Just kidding.) The IRRRL program is “streamlined”, meaning its a very easy process. The lender will verify you have a job, but does not ask for income documentation. As a matter of fact, the income section of the loan application is left blank.

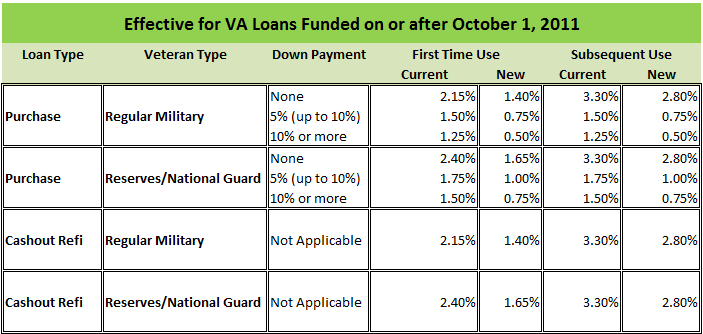

- An extremely low VA Funding Fee – only 0.5%. And in many cases the lender can provide a loan scenario where even the VA Funding Fee is covered with the “lender credit.”

Consult with an Orange County, CA VA Loan Specialist

It is important to make sure to talk with a VA loan specialist. VA financing tends to be specialized. The guidelines for VA financing are much different than for Conventional loans, and consulting with a loan officer who is not familiar with VA financing may result in answers that are not correct. So make sure you are getting the correct answers to your questions when it comes to VA financing.