The benefits of the VA Home Loan for Orange County Veterans are numerous. The VA loan program is an amazing mortgage program that has less restrictive guidelines and underwriting flexibility compared to any other loan program. Some of these benefits include no down payment, no monthly mortgage insurance and competitive fixed interest rates.

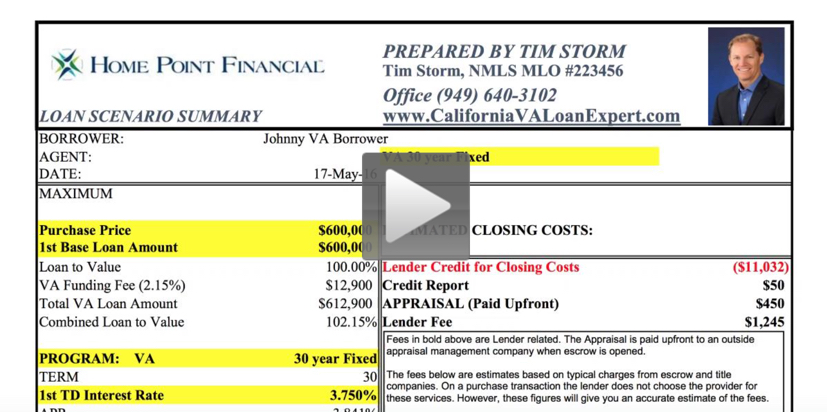

https://www.youtube.com/watch?v=kwzuRd7vdLQ

No Down Payment Required

One of the biggest and most noticeable benefits to the VA loan program is that there is no down payment up to county loan limit. For example, in Orange County the VA loan limit is $679,650, which means a veteran is able to get a VA loan with zero down payment up to a $679,650 purchase price (2018 loan limit). Veterans are able to get a VA loan above the limit, but they would then have a down payment as a result. A loan above the Zero Down limit is called a Jumbo VA Loan and is also fairly common in Orange County due the the high cost of homes.

Competitive Fixed Interest Rates on VA Loans

VA Loans tend to have lower fixed rates than other types of loan programs. VA interest rates are typically .25% or more lower than comparable rates for Conventional financing. These lower rates also make it easier for the lender to offer a lender credit to help cover closing costs. By adjusting the interest rate slightly higher, a lender credit can save the Orange County Veteran thousands of dollars in out of pocket expenses when purchasing a home. Also, the VA loan does not have a prepayment penalty, making it easy to take advantage of the VA Interest Rate Reduction Refinance Loan (VA IRRRL) if rates drop.

The VA loan program is also one of the only programs that allows for loans to be assumable when purchasing a home. This means that when a home is purchased, the buyer can take over the sellers mortgage under the same terms. Besides FHA, no other loan program provides this benefit.

No Monthly Mortgage Insurance

No monthly mortgage insurance is one of the best benefits of a VA loan. For other types of financing, including FHA and Conventional loans, when the down payment is less than 20% of the purchase price there will be some form of mortgage insurance. With FHA, no matter what the down payment is there will be monthly mortgage insurance. for example, an Orange County home buyer purchasing a home for $600,000 would need a 3.5% down payment with FHA. That is a $21,000 down payment. VA would have No Down payment. On the FHA loan the mortgage insurance would be calculated using a factor of .85% of the loan amount divided by 12. The monthly mortgage insurance would be approximately $417, paid every month. An Orange County Veteran purchasing the same home would have no monthly mortgage insurance, saving $417 per month versus the FHA loan.

Underwriting and Credit Flexibility

The VA loan program is also the most flexible home loan program when it comes to credit and debt to income ratios. Many lenders will close VA loans for borrowers with FICO scores as low as 580. Also, VA financing is allowed only 2 years after a bankruptcy or foreclosure. FHA requires 2 years after a bankruptcy and 3 years after a foreclosure. Conventional loans require a 4 year wait after a bankruptcy and 7 years after a foreclosure.

Cash Out Refinance using the VA Loan

A great benefit of the VA loan is as a washout refinance. VA allows cash out up to 100% of the property value. For an Orange County Veteran looking to do home improvements, being able to pull cash out to 100% of the new appraised value means the home improvements can be completed much sooner than someone in another type of loan program. FHA allows cashout to 85% of the property value, and conventional financing only goes to 80%.

Understanding your loan options is important. A Veteran should always consider the VA loan as their first option. There are few scenarios where VA will not be better than another type of loan program. To see the numbers, have your Orange County VA loan officer prepare a Side by Side Analysis comparing the VA loan to other loan options, which will help the Veteran see the numbers and make the correct home financing decision.

Authored by Tim Storm, an Orange County VA Loan Officer specializing in VA Loan. MLO 223456. – Please contact my office at the Home Point Financial. My direct line is 949-640-3102. www.OrangeCountyVALoans.com. I will prepare custom VA loan scenarios which will be matched up to your financial goals, both long and short term. I also prepare a Video Explanation of the your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.