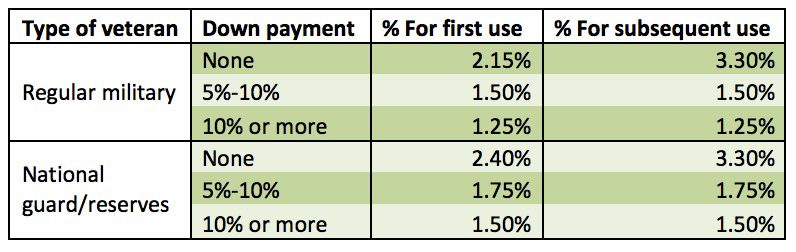

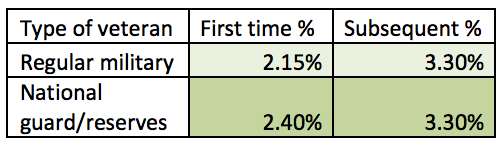

The VA Funding Fee is unique to the VA mortgage program. The funds from this fee go directly to the VA to help cover any losses from loans that default. The VA funding fee is an amount equal to a certain percentage of the loan amount which is based on a variety of factors. These factors include the type of military service performed, whether a down payment is going to be paid with the loan, and if this is the first time using the VA program or a subsequent use. The borrower has the option to either pay the funding fee in cash at closing or to include the funding fee into the financed loan amount. It is extremely rare that a Veteran chooses to pay the VA Funding Fee out of pocket versus financing it into the loan, but it is possible.

Funding Fee Exemption

The VA does allow exemptions to the Funding Fee, but only for a few eligible groups. The main group that is exempt from paying the VA funding fee are veterans that have a service-connected disability rating. The other group that is exempt are surviving spouses of Veterans who died in the service, or as a result of service-related disabilities.

These two charts below include some addition information regarding how the percentage paid for the VA funding fee is determined. This first chart provides information for VA purchase loans:

This second chart provides the percentage details for VA cash-out refinance loans:

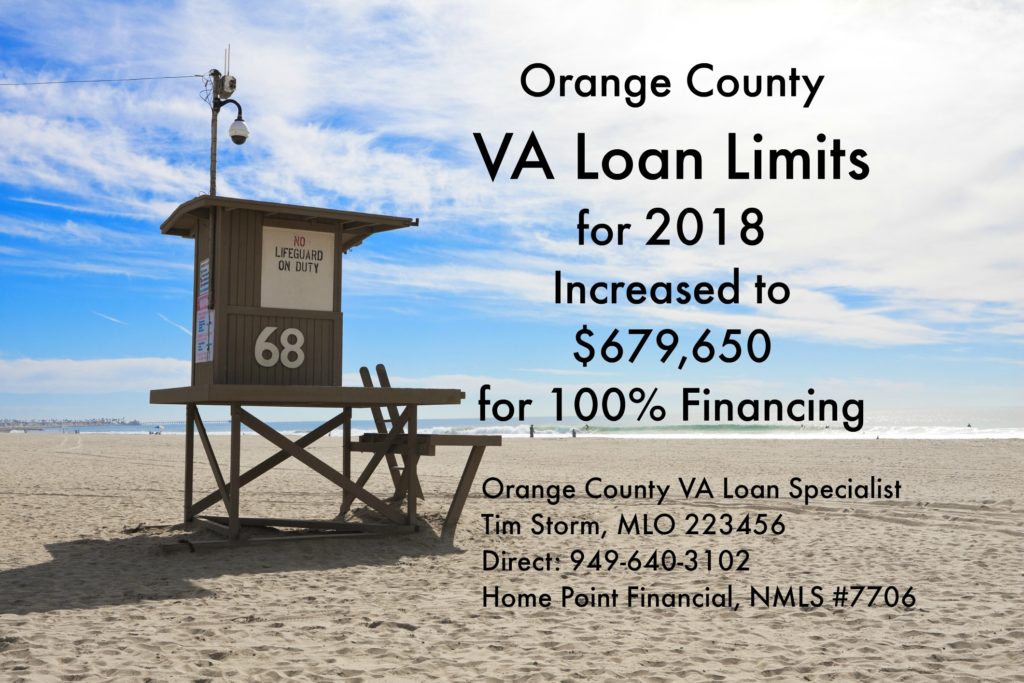

Authored by Tim Storm, an Orange County VA Loan Officer specializing in VA Loan. MLO 223456. – Please contact my office at the Home Point Financial. My direct line is 949-640-3102. www.OrangeCountyVALoans.com. I will prepare custom VA loan scenarios which will be matched up to your financial goals, both long and short-term. I also prepare a Video Explanation of your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.

need to provide proof of service. Form 26-1880 may need to be completed if your lender is not able to get the COE on the first try. Also, the DD214 will need to be turned in to the lender if the COE is not retrieved on the first try. For the VA loan program, copy 4 of the DD-214 is preferred because it is the most detailed regarding your service. Reserve and National Guard members need to send in their most recent annual retirement summary with proof of honorable service attached. If you have been discharged from active duty and don’t have a proof of service form, you can still submit a request for a COE because in some cases the VA can determine your eligibility based on their own records.

need to provide proof of service. Form 26-1880 may need to be completed if your lender is not able to get the COE on the first try. Also, the DD214 will need to be turned in to the lender if the COE is not retrieved on the first try. For the VA loan program, copy 4 of the DD-214 is preferred because it is the most detailed regarding your service. Reserve and National Guard members need to send in their most recent annual retirement summary with proof of honorable service attached. If you have been discharged from active duty and don’t have a proof of service form, you can still submit a request for a COE because in some cases the VA can determine your eligibility based on their own records.

and Conventional loans both on average close in about 43 to 46 days (2017 statistic). On top of that VA loans are also more likely to close than a conventional loan. Because the VA loan program is a “niche”, Veterans should seek out lenders and loan officers who specialize in the VA loan program. An

and Conventional loans both on average close in about 43 to 46 days (2017 statistic). On top of that VA loans are also more likely to close than a conventional loan. Because the VA loan program is a “niche”, Veterans should seek out lenders and loan officers who specialize in the VA loan program. An