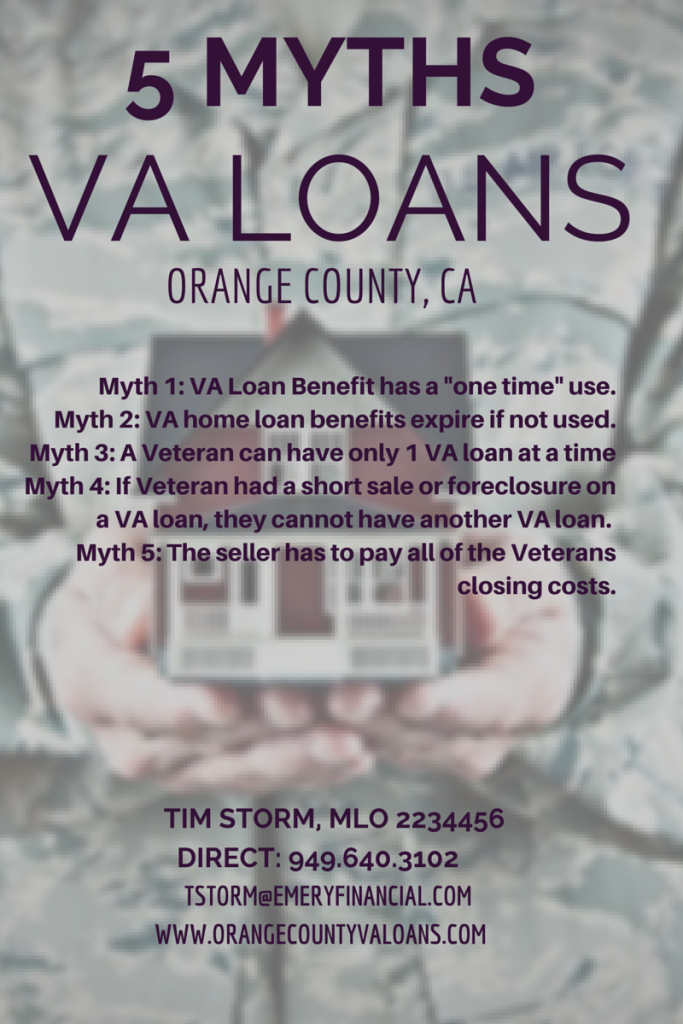

VA loans are probably the most misunderstood mortgage program in Orange County, CA. Real estate agents, Loan Officers, home sellers, and even eligible Veterans often receive incorrect information when they inquire about the VA loan program. A recent VA survey found that approximately half of all military veterans do not understand the VA loan program and how they can benefit from it. With this in mind, below are 5 myths about VA loans that Orange County Veterans, and anyone involved in the sale of a home with VA financing, should know and understand.

VA loans are probably the most misunderstood mortgage program in Orange County, CA. Real estate agents, Loan Officers, home sellers, and even eligible Veterans often receive incorrect information when they inquire about the VA loan program. A recent VA survey found that approximately half of all military veterans do not understand the VA loan program and how they can benefit from it. With this in mind, below are 5 myths about VA loans that Orange County Veterans, and anyone involved in the sale of a home with VA financing, should know and understand.

Myth 1: The VA Loan benefit has a “one time” use.

Fact: Veterans and active duty military can use the VA loan many times. While there is a limit to the Veterans entitlement which determines the amount of VA loan the VA will guarantee, it is important to know that even if the entitlement was used on the previous purchase of a home, once restored, it can be used again. Also, if the borrower has an outstanding VA loan, it is possible to get another VA loan. If the entitlement available is exceeded with the new purchase then a down payment would be required. But the down payment, in many cases, would still be less than that required by other types of loan programs. In Orange County, where the 2015 VA loan limit is $625,500 for 100% financing, there is “bonus entitlement” available for Veteran because of the it is considered a “high cost” area.

Myth 2: VA home loan benefits expire if they are not used.

Fact: For eligible Veterans and active duty military, VA mortgage benefits never expire. This myth most likely comes from the confusion over the Veteran benefit for education. In most cases the Montgomery GI Bill benefits expire 10 years after discharge. But VA mortgage benefits do not expire. It is not uncommon for a Veteran 30 years removed from the military to use the VA loan program for the first time to purchase a home for $625,500 or more in Orange County. The down payment is less ($0 if the price is under $625,500), there is no mortgage insurance, and the interest rates tend to be better than other types of financing.

Myth 3: A Veteran can only have one VA loan at a time.

Fact: You can have two or more VA loans out at the same time as long as you have not exceeded your entitlement and eligibility. Although, as mentioned above, it is possible to exceed the entitlement by coming in with a down payment. It is not uncommon for someone who is moving to Orange County from out of state to purchase a home with a VA loan while already having a VA loan on their out of state property, which has been turned into a rental. Because Orange County has a higher VA loan limit (and bonus entitlement) than most counties throughout the country, Veterans moving from out of state, or even from a low limit California county, will be able to take advantage of their “Bonus Entitlement” that is available in high cost counties like Orange County.

Myth 4: If a borrower has a short sale or foreclosure on a VA loan, they cannot have another VA loan.

Fact: If an Orange County Veteran has a claim on their entitlement they may still be able to get another VA loan. But the maximum amount they would qualify for may be less. VA is actually more flexible than other types of mortgage programs when it comes to the waiting period required after a bankruptcy, short sale or foreclosure. VA only requires a two year wait period for any of these events. FHA requires 3 years after a foreclosure. Fannie Mae and Freddie Mac require 7 years after a foreclosure.

Myth 5: The seller has to pay all of the Veterans closing costs

Fact: The Veteran is allowed to pay most of the closing costs without any restrictions. There are certain costs that are known as “non-allowables”. Non-Allowables are primarily made of up the escrow closing fee and the lender fees. However, the VA borrower is allowed to pay up to 1% of the loan amount towards “non-allowables”. Since most VA lenders do not charge an Origination Fee and will waive lender fees on VA loans, the 1% allowance covers the other non-allowable costs, meaning that the seller does not need to help the Veteran with closing costs. Just like any real estate transaction, everything is negotiable. In Orange County, where a typical VA loan is higher than $300,000, and can easily be higher than $600,000, that 1% allowance more than covers the non-allowables. Also, in many cases the lender can use a “lender credit” to cover the closing costs for the buyer. So it is still possible for a VA buyer to have no down payment and pay no closing costs (a VA No No) without any help from the seller.

The most important first step in the home buying process is getting Prequalified for the loan. For Veterans in Orange County, working with a local VA Loan Specialist is important. The VA loan officer should be able to prepare custom loan scenarios and present them in a unique manner that makes it easy to understand the options available.

Authored by Tim Storm, an Orange County VA Loan Officer specializing in VA Loans. MLO 223456 – Please contact my office at the Emery Financial. Direct line at 949-640-3102. www.OrangeCountyVALoans.com. I will prepare custom VA IRRRL loan scenarios which will be matched up to your financial goals, both long and short term. I also prepare a Video Explanation of your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.

The

The