VA loan refinancing has picked up quite a bit in Orange County in 2012. And it’s not just current VA borrowers taking advantage of the VA to VA Interest Rate Reduction Refinance Loan, also known as the IRRRL. Veterans are also refinancing out of Conventional loans and into VA loans.

VA loan refinancing has picked up quite a bit in Orange County in 2012. And it’s not just current VA borrowers taking advantage of the VA to VA Interest Rate Reduction Refinance Loan, also known as the IRRRL. Veterans are also refinancing out of Conventional loans and into VA loans.

Why Refinance from Conventional to VA?

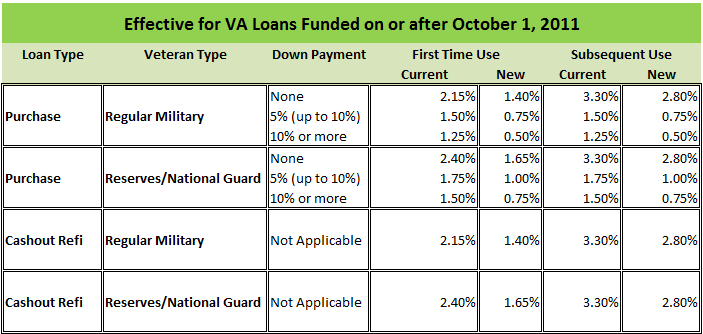

VA loan guidelines offer several advantages over typical Conventional loan guidelines. Lower FICO score requirements, less equity, higher debt to income ratios, and less time needed after a foreclosure or bankruptcy are all reasons why VA refinancing has been so popular in 2012. Also interest rates on a VA loan tend to be as low or sometimes lower than other types of loans. And while VA does have a Funding Fee which is financed into the loan, there is no Monthly Mortgage Insurance which is typical for other high loan to value financing.

Orange County has high loan limits for VA Financing

Orange and Los Angeles counties have high 100% financing limits for VA loans. It is possible to buy or refinance with no down payment or equity up to a $687,500 (2014 limit) loan amount. That is higher than the high balance Conforming loan limit of $625,500. Plus, it’s possible to get financing as high as $1,500,000. There is an equity requirement when the loan is over $687,500 equal to 25% of the difference between the appraised value and the 100% limit. For example, if an Orange County Veterans home appraises for $887,500 then the max VA loan would be $837,500.

How do you know if a VA loan is for you?

A VA loan is not the best loan in every situation. It’s important to compare your options. Find a local Orange County lender who specializes in VA financing. Have the lender prepare a custom Side By Side analysis comparing your current loan to a VA loan and whatever others options that are available.

Authored by Tim Storm, a California Mortgage Loan Officer MLO 223456 – Please contact my office at the Emery Financial. Direct line at 949-640-3102. www.OrangeCountyVALoans.com