The real estate market is going through some changes that are affecting buyers and sellers, but experts say one thing remains constant: purchasing a home still makes sense. Rapidly rising housing prices has pushed many prospective homeowners back onto the fence. Typical among first time buyers, rising prices puts them on the sidelines until their next rent increase. Eventually they realize that they just need to bite the bullet and buy a home, especially while interest rates are still low.

However, demand isn’t the real issue. Instead, it’s the lack of supply (homes available for sale). An article from the Wall Street Journal shows this is true for new home construction:

“Home builders have sold more homes than they can build. Now they are limiting their sales in an effort to catch up.”

If the slowdown in sales was the result of demand waning, we would start to see home prices beginning to moderate – but this isn’t the case. As Mark Fleming, Chief Economist for First American, explains:

“There’s a lot of conversation around rising prices and falling quantity in the housing market, and there’s this concept, or this idea, that it’s a demand-side problem . . . . But, if demand were falling dramatically, we would actually see less price pressure, less home price growth.”

Instead, we’re seeing price appreciation accelerate throughout this year, as evidenced by the year-over-year percentage increases reported by CoreLogic:

- January: 10%

- February: 10.4%

- March: 11.3%

- April: 13%

- May: 15.4%

- June: 17.2%

(July numbers are not yet available)

There’s a shortage of listings, not buyers, and there are three very good reasons for purchasers to still be interested in buying a home this year.

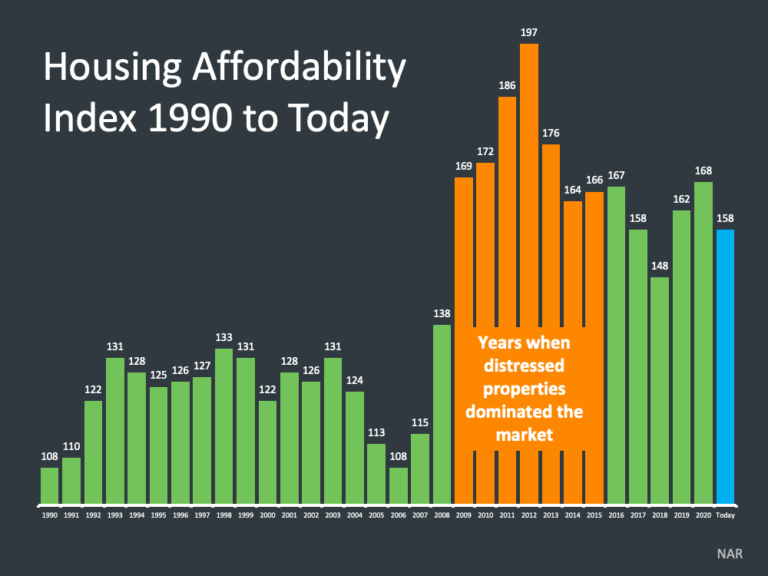

1. Is Affordability really a problem right now?

While many people say that affordability is a problem, it's really not a problem for most home buyers. Interest rates have remained low through 2021 which has helped affordability. Even with the increase in property value since the beginning of 2020, mortgage payments are more affordable now that at almost any time since 1990.

2. Interest rates are still low. But what about next year?

Interest rates have remained extremely low since COVID took hold in early 2020. But now, as we enter the 4th Quarter of 2022, the Federal Reserves has plans to begin raising short term rates. And more importantly for long term mortgage rates, the Fed will begin "tapering" their purchases of Mortgage Backed Securities. Tapering is bad for mortgage rates. Inflation, which is another concern, is also bad for mortgage rates. As the economy recovers from the effects of COVID and the supply chain problems persist, inflation will be a concern. The Mortgage Bankers Association predicts mortgage rates will rise to 4% by the end of 2022. The MBA expects the average 30 year rate in 2021 to end up being 3.1%. On a $500,000 loan amount that difference in interest rate is equal to a $252 payment difference. That payment difference is roughly $50,000 in purchasing power. Why wait?

3. Home Price Appreciation forecast is 7.9%

Even with interest rates expected to rise, homes prices are still expected to appreciate by 7.9% in 2022 according to Fannie Mae. Even though the media has been reporting a slow down in home sales it's important to understand that a slowdown in sales is not the same thing as a drop in real estate prices. Zillow expects prices to increase 11.7% over the next 12 months. The California Association of Realtors expects the median home price in California to increase 5.2%.

Cost of Waiting

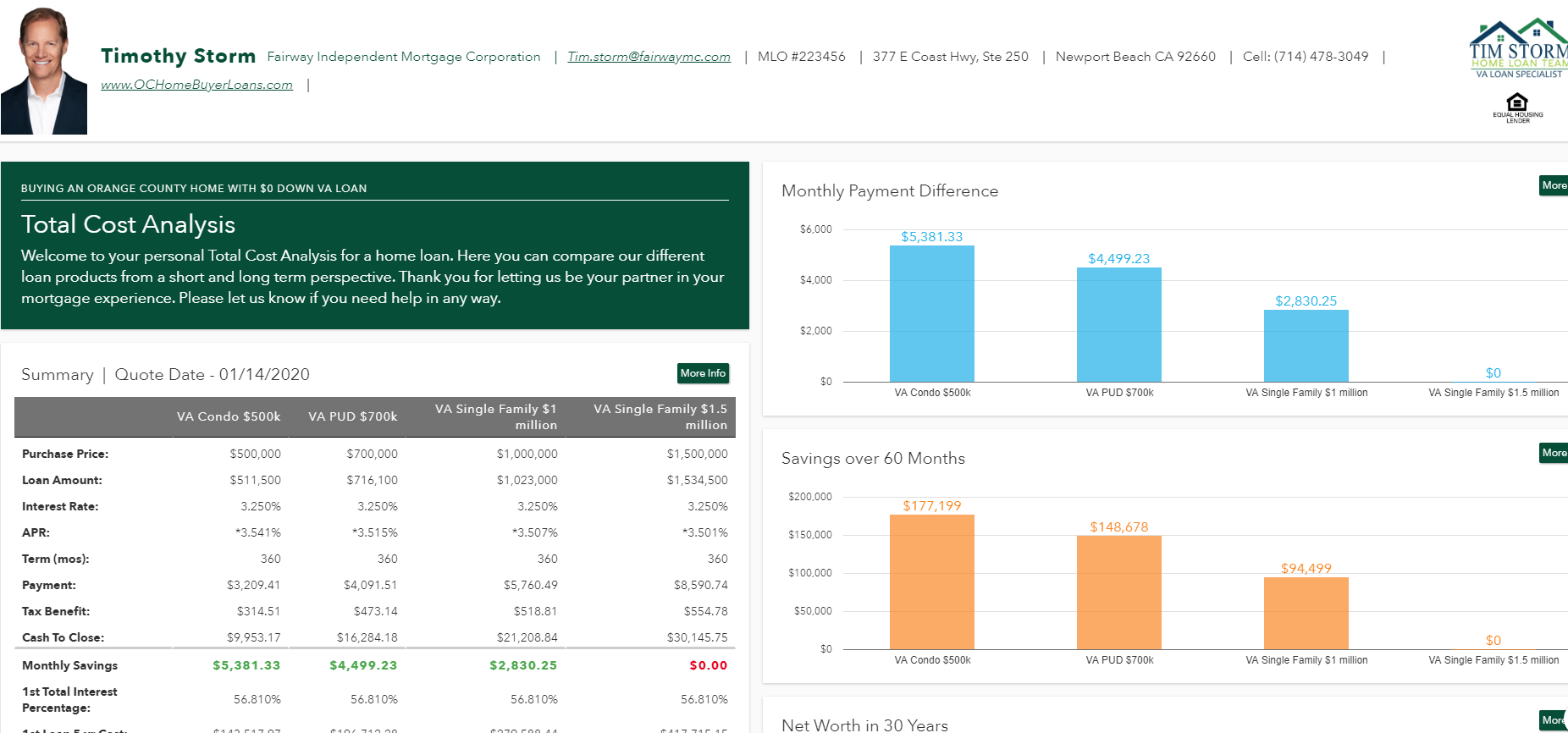

The Cost of Waiting is a calculation that compares buying a home today versus waiting and buying at a later date. The reasons for waiting include wanting to save more down payment, paying off debt, improving credit and FICO scores, or just waiting out the market and waiting to see if there is a "crash". Let's assume you are looking to buy a home for $600,000.You have 5% down but want to save another 5% before buying a home. So you have $30,000 and feel the need to save another $30,000 so that your Private Mortgage Insurance is cheaper. The total PITI would be in the $3,300 range with a 5% down payment and assuming Fannie Mae's average rate of 3.1% for 2021. The loan amount would be $570,000. In 12 months you would have paid the balance down to $558,296 and your property would be worth $632,000. You would have $73,000 in equity in the home.

But if you waited 12 months so that you would have 20% down then this is what that would look like. The home you're buying is now $632,000. 10% down gives you a loan amount of $568,800. The PMI would be less since we are now assuming a 10% down payment, but interest rates are higher using the 4% forecast from Fannie Mae. The total PITI ends up being $3,495.

By waiting 12 months, the mortgage payment is $195 higher. There is 10% less equity. You paid another year of rent. And you're stuck for a 4% interest rate. It's also interesting to consider what would happen if property values did drop 10% but interest rates were at 4%. If the $600,000 property was bought for $540,000 with 5% down in 12 months when rates are 4%, the total payment would still be $3,220. The risk in waiting to buy definitely seems to be in favor of buying now versus waiting to buy later.

VA Loan PreApproval

The most important step in the home buying process is to get PreApproved. Veterans have access to the best mortgage program out there, the VA loan program. VA allows for Zero Down Payment to "any" purchase price, as long as the Veteran has enough income to qualify for the payment. Working with an experienced VA Loan Office is critical in making sure the buyer understands the numbers and gets a solid PreApproval.

Authored by Tim Storm, a California Mortgage Loan Officer MLO 223456 – Please contact my office at Fairway Independent Mortgage Corporation. Direct line is 949-829-1846. www.OrangeCountyVALoans.com