What does it take to buy a $700,000 home in Orange County with a VA Loan? The biggest hurdle for most first time home buyers is the down payment. But for Veterans eligible to use the VA loan program, the down payment hurdle is removed. VA allows Zero Down payment with no limits to the purchase price. However, there are still closing costs to contend with. And the Veteran does need to have enough income to qualify for the VA loan, along with decent credit.

Let's take a look at what the approximate payment would be for a $700,000 home price assuming a VA interest rate of 3.5%. Interest rates can change daily, so this is just meant as a guide to the range of numbers to expect. We'll also look at the estimated funds to close and the estimated income that would be need to qualify for the VA loan.

Below is a video that will talk you through the numbers for a $700,000 purchase using a VA loan with $0 down payment.

The Payment Breakdown = PITI

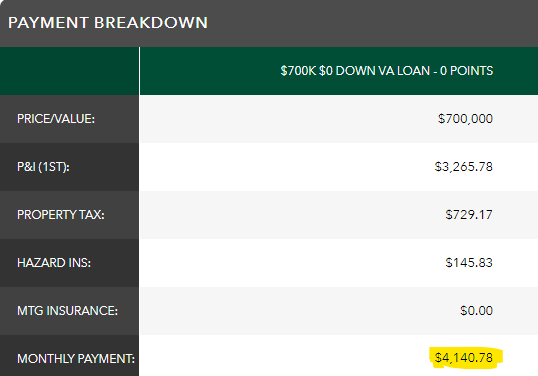

Below is a screenshot of the payment breakdown for a $700,000 purchase. There are four primary components to a mortgage payment, also know as PITI.

- P = Principal

- I = Interest

- T = Taxes (property taxes)

- I = Insurance (Homeowners Insurance)

As shown below the P&I is $3,256. The property taxes are estimated to be $729. The Homeowners Insurance is estimated to be $145. The total PITI is $4,140. Also, if the property is a condo then you would need to add the Homeowners Association Dues to the over all payment. The typical HOA dues for an Orange County condo is in the $350 range. One more important fact since we're talking about condos. If you are looking to buy a condo in Orange County using the VA loan program then you will need to make sure the condo is in a "VA approved" condo complex. There are two great websites that will specifically help Veterans find VA approved condos in Orange County.

How much income is needed to qualify for a $700,000 VA home purchase?

VA guidelines require a review of the Veterans income. The Debt to Income ratio guideline for a VA loan is 41%. This means that 41% of a Veterans total income, or "Gross Income" BEFORE taxes, can go towards the housing payment AND any other installment payments and minimum payments on credit cards. Child care is also included in the expense side of the equation. If we assume a Veteran has no other payment and is trying to qualify for a $4,140 PITI mortgage payment, then their Gross Income will need to be $10,097. However, 41% is just the guideline. It is not unusual to get loan approval even when the DTI is 55%. This means it's possible the Veteran would only need $7,500 per month or $90,000 per year to qualify. But remember, if there is a car payment or other monthly payments, then the income will need to be higher.

How much money is needed to buy a $700,000 Orange County home with a VA Loan?

This is sometimes a surprise for first time VA buyers. Even though there is no down payment, there are closing costs and prepaid expenses to contend with. The escrow and title companies still need to get paid, along with the appraiser and notary. PrePaid expenses include mortgage interest, prorated and "impounded" property taxes and insurance. Altogether, the amount of money needed to close on a $700,000 purchase can easily end up being between $10,000 and $15,000, depending on several factors. There are ways to dramatically lower the amount needed to close by adjusting the interest rate or negotiating to have the seller pay closing costs. Currently we are in a Sellers Market, meaning that Sellers have the upper hand in negotiations. Getting a seller to pay for closing costs in Sellers market will be difficult. So working with an Orange County VA lender who knows who to structure and present your options will be important.

A frequently asked question comes up about the VA Funding Fee. Veterans who have a minimum 10% service connected disability rating will not have a VA Funding Fee. Otherwise, the Funding Fee is financed into the VA loan. The amount of the fee depends on several factors, including whether it is the first usage of VA financing or "subsequent usage". Also, it the VA Funding Fee is slightly different for Reserves/National Guard. A down payment of 5% or 10% will lower the VA Funding Fee. What is important to understand is that even a 100% disabled veteran will still have the normal closing costs associated with a transaction.

Request your FREE VA Purchase Analysis

The first step in the home purchase process is to request a Purchase Analysis. In this case, a VA Purchase Analysis. The VA Purchase Analysis will give you a clear and concise breakdown of the numbers you need to know, side by side.