VA has announced the increase of the 2017 VA loan limits.

What is the “VA loan limit“?

The Veterans Administration (VA) sets a limit of what a qualified Veteran buyer, with full entitlement, can borrow within each county without making a down payment. They calculate this limit based on the average price a home is selling for in that county. That means that in places like Orange County, CA the limit will be significantly higher than in a county with lower housing prices like Riverside County. This does not mean that you cannot purchase a home at a higher sales price (that would be a Jumbo VA Loan), just that you as the buyer, will be responsible for coming in with 25% of the difference between the loan limit and the purchase price. And if you think about it, that is a very favorable formula for those Veterans who want to purchase a home for a price higher than $636,150. Jumbo VA loans in Orange County, CA are fairly common.

“VA does not set a cap on how much you can borrow to finance your home. However, there are limits on the amount of liability VA can assume, which usually affects the amount of money an institution will lend you.” -Department of Veterans Affairs website

What the loan limit increase means for Orange County and Los Angeles County VA Buyers

This is an encouraging change for many prospective VA qualified buyers that have the income, satisfactory credit, appropriate debt-to-income ratios but may not have the savings for a conventional or FHA loan program. The VA loan limit for Orange and Los Angeles Counties is now at $636,150. That is up $10,650 from last years limit of $625,500. As housing prices increase in this popular area it is a welcome opportunity.

Let’s look at the highest purchase price for the new loan limit, showing a Veteran using benefits for the first time w/ 100% financing:

Purchase Price: $636,150 (<–Anything higher than this, the buyer will need a down payment equal to 25% of the difference between the loan limit and purchase price = Jumbo VA Loan)

Down Payment 0%

Base Loan Amt: $636,150

VA Funding Fee 2.15%: $13,677 – (assuming this is first time use for Regular Military with no Disability waiver)

Total VA LA: $649,827

We see that with the VA loan limit increase this year buying in Orange County or Los Angeles county now becomes a tangible option for more borrowers that are ready to take the leap into homeownership.

Do I have to have a VA funding fee? If so, what is it?

The VA Funding Fee is a set percentage, traditionally combined into the final loan amount, that will go directly to VA to help cover any losses accrued by loans going into default. The fee amount will change to accommodate the borrower’s unique circumstances. Some common factors to consider when calculating the amount would be purchase price, the nature of the borrower’s service, if they’ve had a previous VA loan, surviving spouse of a soldier, and if they choose to bring in a down payment. There are some Veteran’s that will not have a VA Funding Fee, if they receive service connected disability benefits from VA making them Exempt from the Funding Fee. Refer to the tables below to see which funding fee that would apply to your buying situation:

| VA Funding Fee for Regular Military Borrowers | ||

| Down Payment | 1st Use Funding Fee | Subsequent Use Funding Fee |

| None | 2.15% | 3.30% |

| 5% – 10% | 1.50% | 1.50% |

| 10% – Higher | 1.25% | 1.25% |

| VA Funding Fee for Reserves & The National Gaurd | ||

| Down Payment | 1st Use Funding Fee | Subsequent Use Funding Fee |

| None | 2.40% | 3.30% |

| 5% – 10% | 1.75% | 1.75% |

| 10% – Higher | 1.50% | 1.50% |

Bottom Line:

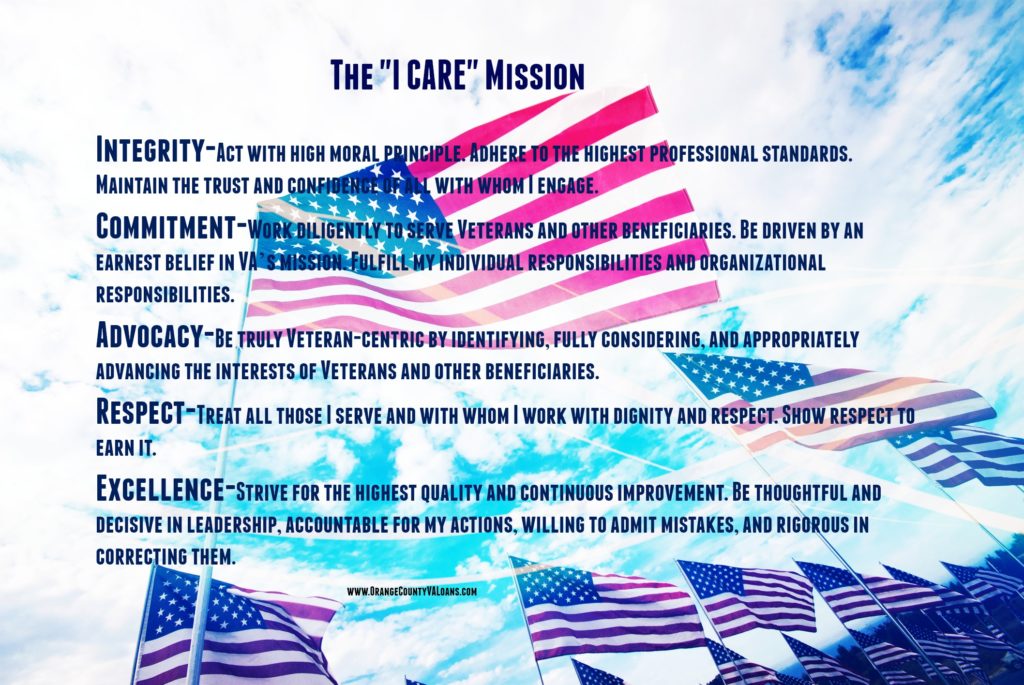

VA is certainly staying true to their “I CARE” values as they work to steadily adjust with the economy, and benefit the Veteran and military service members. They will effectively help many families to realize their dream of owning a home with an Orange County zip code this year.

Authored by Tim Storm, an Orange County VA Loan Officer specializing in VA Loan. MLO 223456. – Please contact my office at the Home Point Financial. My direct line is 949-640-3102. www.OrangeCountyVALoans.com. I will prepare custom VA loan scenarios which will be matched up to your financial goals, both long and short term. I also prepare a Video Explanation of the your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.

Google+