Good news for Orange County, CA Veterans as the Department of Veterans Affairs announced that the Funding Fee on VA loans will decrease. VA Circular 26-11-12, released on September 8, 2011, gives the breakdown of the decrease, which could save Orange County homes buyers using the VA loan program throusands of dollars, depending on the purchase price of the home they are buying. The new Funding Fee rates go into effect for all loans closed on or after October 1, 2011, and is in effect for 12 months.

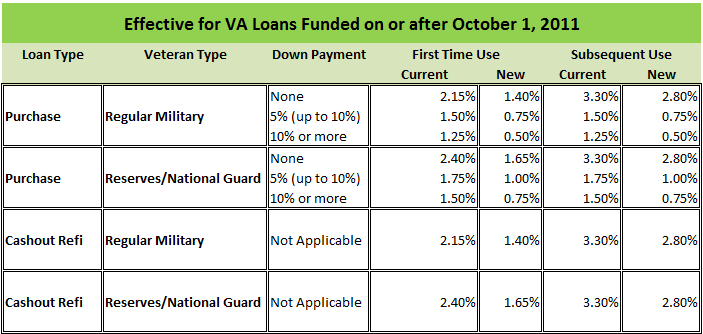

VA Funding Fee Chart for Loan Closed On or After October 1, 2011

Example of Benefit to Orange County, CA VA Loan borrowers

How much will this be a benefit to Orange County home buyers using VA financing? Well, because home prices tend to be on the high end in most parts of Orange County, the lower Funding Fee percentages will save thousands. For example, an Orange County Veteran purchasing a home in Irvine for $500,000 with no down payment, and using their VA eligiblity for the first time, would need have a Funding Fee of $10,750 added to their loan. ($500,000 * 2.15% = $10,750.) Using the new percentage, the Funding Fee would only be $7,000. ($500,000 * 1.4% = $7,000.) That saves this Irvine Veteran$3,750. The Funding Fee is financed into the loan, so the Veteran won’t actually feel the savings immediately, but there will be an effect on the monthly payment, in this case about $35 per month.

VA Loan PreApproval is the First Step

The first step in determining how this change will effect your purchase is to contact a local Orange County VA lender. A VA loan specialist will be able to prepare custom loan scenarios based on your qualifications and payment comfort level. The scenarios will give you a complete breakdown of the purchase price, loan amount, payment, closing costs, and amount needed to close. If you are planning on going with a “VA NO NO“, where you not only don’t come in with a down payment but also have the seller pay your closing costs, the scenarios will let you know how much of a seller credit is required. It is also possible to adjust the interest rate in order receive a lender credit towards closing costs. Your financing should be determined prior to making offers on homes.

Google+

[…] about to get a nice surprise, as the Department of Veterans Affairs recently announced they would lower the VA Funding Fee. The drop will help save thousands for VA Loan borrowers in California. The typical charge for […]